pittsburgh pa local services tax

City of Pittsburgh residential. Local Income Tax Information.

31st Ward Community Action Group Pittsburgh Pa Facebook

CITY CODE TITLE TWO CHAPTER 252.

. You should pay. Residents of Pittsburgh pay a flat city income tax of 300 on earned income in addition to the Pennsylvania income tax and the Federal income tax. Fee will be assessed for any check returned from the bank for any reason.

ARTICLE II IMPOSITION OF TAX SECTION 201 TIME FRAME A Local Services Tax has been levied pursuant to the City Code Title II Article VII Chapter 252 for the period January 1 thru December 31 for the purposes of supplementing the funds for 1. CITY CODE TITLE TWO CHAPTER 252. Or 3 reduction of property taxes a tax is hereby levied in the amount of fifty-two dollars 5200 upon the privilege of engaging in an occupation within the City for each calendar year.

Employee must show proof that 10 was withheld the rate of the Local Services Tax is 52 for Pittsburgh. Jordan Tax Service Inc. Does the eme to pay theployee hav Local Services Tax to the City of Pittsburgh.

Pennsylvania law limits total payment by one person to a maximum of 5200 per year regardless of the number of employers in a year. Location or proof that the employer is remitting Local Services Tax or local municipal tax eg. CITY OF PITTSBURGH LOCAL SERVICES TAX FOR EMPLOYERS OR SELF-EMPLOYED INDIVIDUALS.

If the employee works the rest. If the taxpayer believes that the Local Services Tax or the Payroll Tax has been collected by the City in error the taxpayer may seek a refund after the close of the year. Local governments may wish to consult with their solicitors on whether and how they might explore alternatives to waive interest andor penalties for local tax filings and payments that are made.

DCED lacks the legal authority to extend the statutory local filing and payment deadline of April 15. Below are examples of two generic LST codes one that is a 10 per year tax and is withheld out of one check and the second is a 52 per year tax and is withheld a little at a time. City 1 School district 2.

The local tax filing deadline is April 18 2022 matching the federal and state filing dates. DUE DATEThe last day of the second month after quarter end for the prior quarters activity. Local Services Tax and you expect to make over 12000 in the City of Pittsburgh this year you are required to pay the tax yourself using this form.

This is the date when the taxpayer is liable for the new tax rate. For a total of 52. Pittsburgh PA 15219-2476 The municipality is required by law to exempt from the LST employees whose earned income from all sources employers and self-employment in their municipality is less than 12000.

Pennsylvania Local Services Tax LST. In June the employee started a new job in Pittsburgh earning 5000 a month. Offers comprehensive revenue collection services to all Pennsylvania school districts municipalities counties and authorities including current tax and utility fee collection.

Local Services Tax LST Act 7 of 2007 amends the Local Tax Enabling Act Act 511 of 1965 to make the following major changes to the Emergency and Municipal Service Tax EMST Name Change. Local Services Tax is 5200 per person per year payable. Our mission is to improve the quality of life for Pennsylvania citizens while assuring transparency and accountability in the expenditure of public funds.

City State Zip. Tax and utility bill printing. Tax rate for nonresidents who work in Pittsburgh.

For the purpose of supplementing the funds for 1 police fire andor emergency services. CITY TREASURER LS-1 TAX 414 GRANT ST PITTSBURGH PA 15219-2476. 400 North Street.

Local Services Tax is 5200 per person per year payable quarterly. For information call. CITY TREASURER LS-1 TAX 414 GRANT ST PITTSBURGH PA 15219-2476 A 3000 fee will be assessed for any check returned from the bank for any reason.

2 road construction andor maintenance. Local Income Tax Forms for Individuals. If you prefer a refund for 2021 please contact the Finance Department by phone at 412 255-2525 or via email at parkstaxrefundpittsburghpagov.

Taxpayer Application for Refund of Local Services Tax LST January 1 1970. Any overpayment from the Parks Tax can be applied to your 2022 tax bill if requested. To connect with the Governors Center for Local Government Services GCLGS by.

Failure to file will result in the imposition of a penalty and interest charge. PSD Code and EIT Rate lookup by county school district or municipality in PA. 5½ Mills 0055 or 55.

How do I find local Earned Income Tax EIT Rates and PSD Codes. Business Privilege Tax at that home office location. Nonresidents who work in Pittsburgh pay a local income tax of 100 which is 200 lower than the local income tax paid by residents.

Give less of your money to the government and keep more in your paycheck. And comprehensive data accounting banking. CITY OF PITTSBURGH LOCAL SERVICES TAX FOR EMPLOYERS OR SELF-EMPLOYED INDIVIDUALS.

Delinquent tax and municipal claim collection. The name of the tax is changed to the Local Services Tax LST. 13 per quarter.

Ad Dave Ramseys tax advisors are redefining what it means to do your taxes right. To connect with the Governors Center for Local Government Services GCLGS by phone call 8882236837. Local Services Tax for the municipality or school district in which you are primarily employed.

Flat 10 Local Services Tax and paid 10. The Deputy Director of Finance serves as City Treasurer. Local Withholding Tax FAQs.

Tax Forms Business Discontinuation Form Local Tax Forms Parking Tax Amusement Tax Quarterly Tax Forms Pittsburghpa Gov

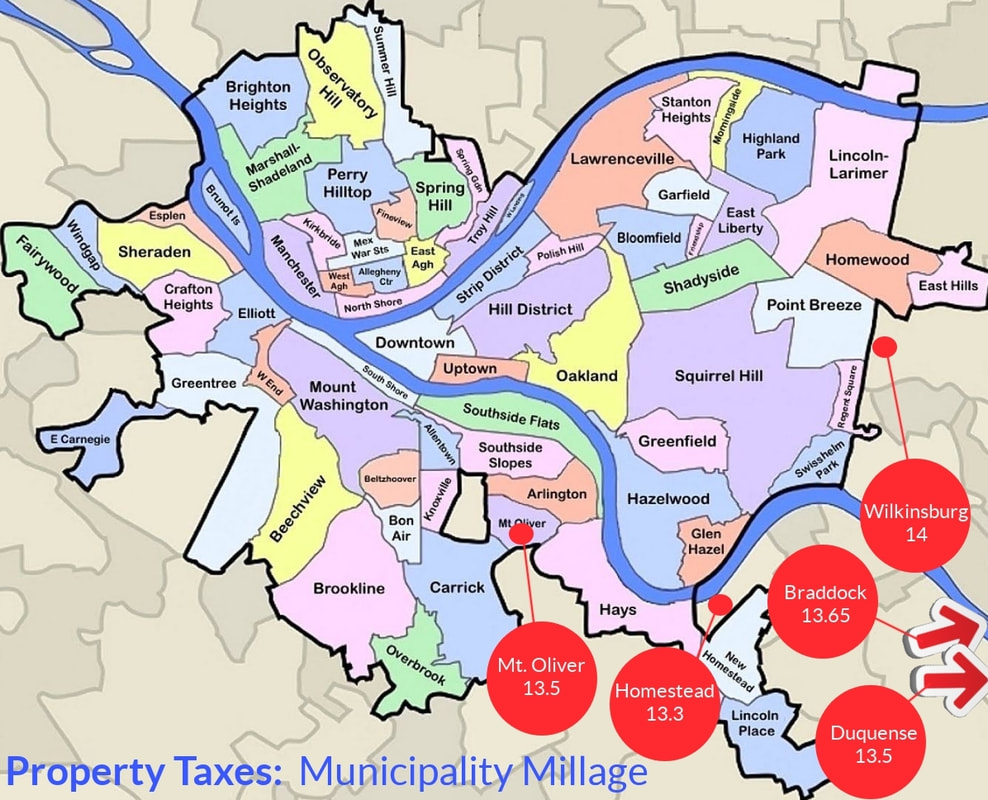

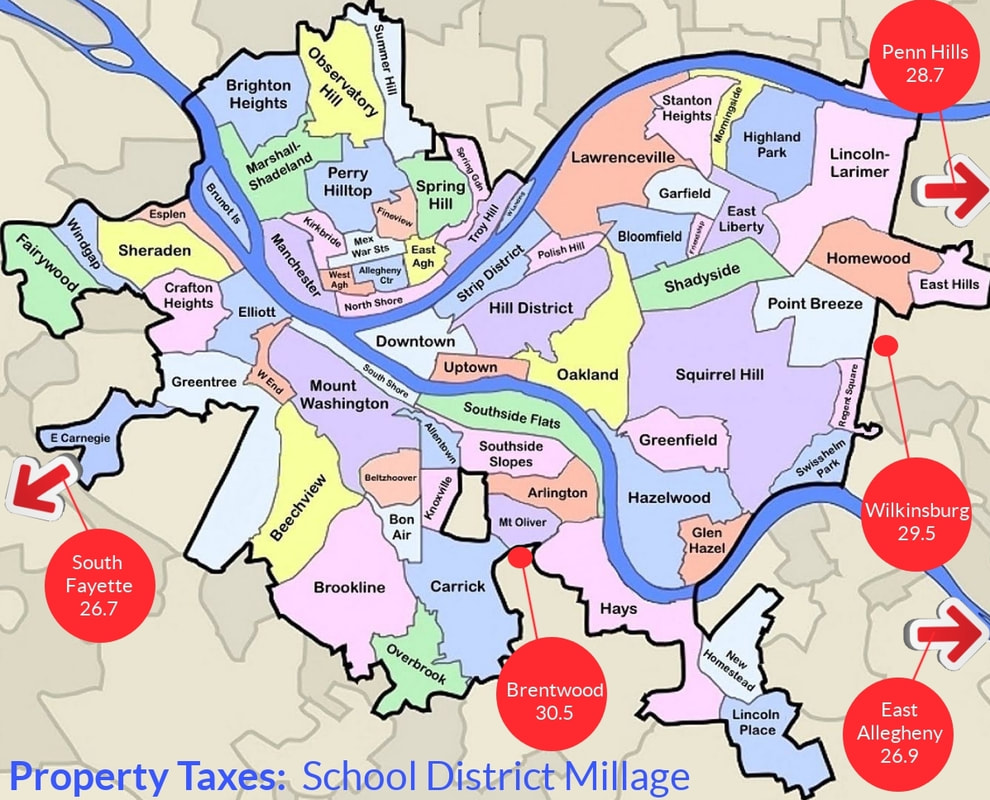

A Guide To Pennsylvania Property Tax By Jason Cohen Pittsburgh Pittsburgh Pa Patch

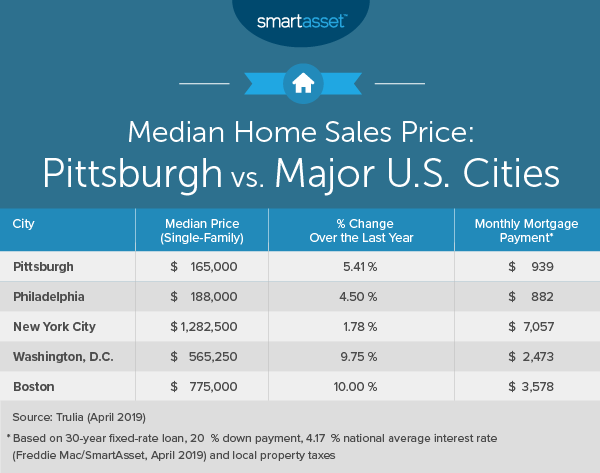

The Cost Of Living In Pittsburgh Smartasset

Johnny Garneau S American Style Smorgasbord Restaurant On Business Pennsylvania History Pittsburgh Pa Route 22

East Pittsburgh Borough An Allegheny County Borough

Best Nursing Homes In Pittsburgh Pa Retirement Living

Payroll Services Tax Hr In Pennsylvania Primepay

City Planning Planning Projects Programs Buildingeye App Zoning Development Gis Department

The Oakland Plan Pittsburghpa Gov

Overview Of Bbmp Property Tax In Bangalore Property Tax Property Rental Solutions

A Basket Of Pittsburgh Home Facebook

Tax Forms Business Discontinuation Form Local Tax Forms Parking Tax Amusement Tax Quarterly Tax Forms Pittsburghpa Gov

The Cost Of Living In Pittsburgh Smartasset

Dosh Relocating To Pittsburgh Pittsburgh Taxes Dosh